35+ is mortgage payment tax deductible

Homeowners who bought houses before. Browse Information at NerdWallet.

Excel Nper Function With Formula Examples

Also if your mortgage balance is 750000.

. Web Is mortgage insurance tax-deductible. But if not you can deduct them pro rata over the repayment period. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

If you refinanced the points you can deduct are divided up over the. For example if you. Take Advantage And Lock In A Great Rate.

Payments you make to a lender on your home mortgage are still deductible on your federal income tax return. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the.

Web Eligible W-2 employees need to itemize to deduct work expenses. Web If you just purchased your home you can deduct all of the points you paid in the same tax year. However higher limitations 1 million 500000 if married.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web However another cost of paying off a mortgage early is higher taxes. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

If you are a single filer a married couple filing jointly or the leader of your household you could save money on the. Use NerdWallet Reviews To Research Lenders. Mortgage interest is tax deductible.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. 13 1987 your mortgage interest is fully tax deductible without limits. Web At this time the ceiling is set at 750000.

Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property. Web 35 mortgage interest deduction limits Jumat. Web If you took out your mortgage on or before Oct.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Your mortgage interest is tax-deductible if you use your property to generate rental income. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you decide.

Come tax time you would use the rental income and expenses. Ad Learn More About Mortgage Preapproval. Web These costs are usually deductible in the year that you purchase the home.

Discover Helpful Information And Resources On Taxes From AARP. For example Lenas first-year interest expense. Web Lets clear the air on the first point.

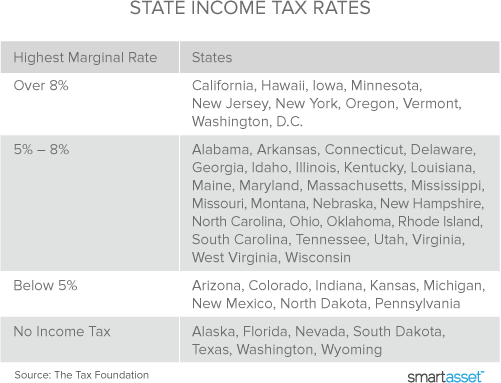

Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than. Web You can only deduct a total of 10000 5000 for those married filing separately for property taxes plus state and local income taxes or sales tax instead of.

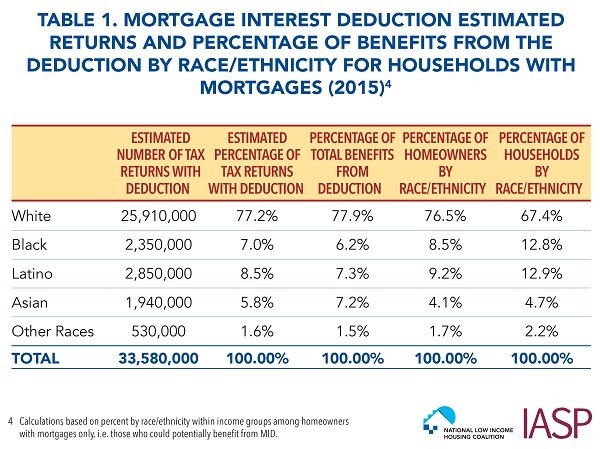

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Deduction A Guide Rocket Mortgage

Social Security United States Wikipedia

Mortgage Interest Tax Deduction What You Need To Know

Just Some Numbers On A 500k Mortgage 1 74 2020 Early 2022 V S 5 1 Now R Canadahousing

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

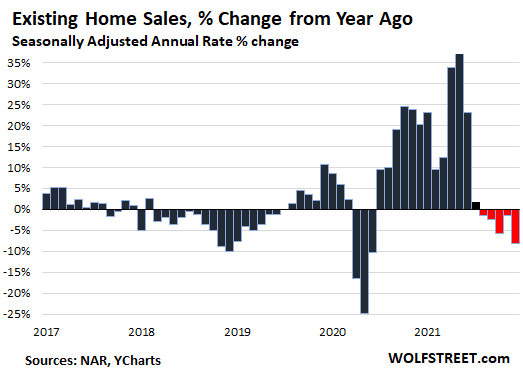

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Mortgage Interest Tax Deduction Smartasset Com

How Much Mortgage Interest Is Tax Deductible

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

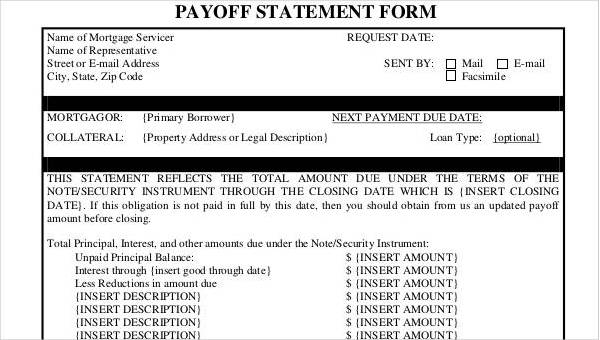

Free 35 Printable Statement Forms In Pdf Excel Ms Word

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Are Your Mortgage Payments Tax Deductible In 2022

Mortgage Payment Tax Calculator Deduction Calculator

What Is The Difference Between Tax Deductions And Tax Credits Quora

What Tax Breaks Do Homeowners Get In New York

35 Best Must Have Wordpress Plugins For 2023 Free Paid